Corporate greed in the Final Fantasy 7 remake

Looking at incentive of corporations and economic theory behind it

Final what?

I do not need to tell you that the Final Fantasy series is brilliant. The numbers tell the whole story:

there were more than 50 entries released between the 1980s and 2021 (that’s 34 years - slightly older than my wife)

around $12 billion in mullah made (before taxes) on this game franchise

Interesting fact: the game creator was heavily inspired by Dungeons & Dragons (D&D), a table-top role-playing game, which you can find in shows like The Stranger things, Big Bang Theory and more.

Seems like D&D genuinely the OG (Original Gangsta) for gamers and pop culture fans alike.

For people not familiar with the series: every numbered entry (i.e. Final Fantasy 1,2,3 etc.) is a self-contained story that does not intersect with the previous or the next game. Only a few in-game elements might be similar: the presence of magic, crystals and Chocobos.

A single game in the series sells more than 2.5 million copies on average (a feat that many popular games never manage to achieve in their lifetime). Yet, the undisputed "king of the hill" is Final Fantasy 7.

Originally released on PlayStation 1, it sold more than 15 million units! (that's whooping 6 times the average for the series - quick maths). I really wanted to understand why it was such a popular game, but I didn't want to play a game from the 90s.

By the way, if you want to get even nerdier on the numbers - click here for an excellent video by IGN

FF7 was so popular, they released a prequel, a sequel and a movie. I watched the movie, titled Final Fantasy 7 Advent Children, around 2007 - the graphics were sooo siiiiick for that time. Still, I barely understood what was going on.

Thus, I was thrilled when the Final Fantasy 7 Remake was announced. Many years later, in 2020, I finally got my hands on a copy. And what can I say - it has been a blast.

But this article is not about what it's like playing the game. It is about what you can learn if you look beyond entertainment. In this article: corporate greed (yep, this game brings up such themes).

Corporate greed in FF7

It won't be a major spoiler to say that one of the baddies in the game is a major global corporation called Shinra. It is modelled after a Japanese Zaibatsu, a conglomerate where succession is based on birthright (still very prevalent in many parts of the world apart from Asia).

Whilst it brought technological advancement into the world: urban planning, space exploration, advanced weaponry, it also has its fingers in advanced genetic engineering and the energy sector.

What you find early in the game - most of that technological advancement (and their civilisation) is fuelled by Mako, an energy source found within the planet and converted into electricity. Like real-life non-renewables like fossil fuels, Mako gets extracted from the planet at an industrial scale, which has profound consequences for the ecosystem.

The primary location of the FF7 Remake is Midgar (name inspired by Nordic mythology, I believe 🧐), and it is the largest city on the planet. Powered by Mako Reactors located at the periphery, Midgar is broken up into sectors and served by the Shinra Corp. Thus, it only makes sense that their headquarters are also based there.

Whilst Shinra’s true intentions are revealed later in the game, I wanted to talk about the intentions of real-life global corporations. But more interestingly, one man in the 20th century whose theory has changed it all. A doctrine that has redefined what a company's priorities are.

History of corporate greed

We probably all have heard of corporate greed by now since the news are ridden with such headlines. But has it always been the case? Yes and No.

Looking at the US as an example, it is the closest we could get to a perfect market (unless you know otherwise?). In the 19th century, the economy was dominated by private companies like Carnegie Steel, US Railroads & Standard Oil, with the majority shareholder being one person - Andrew Carnegie, Cornelius Vanderbilt & John D. Rockefeller, respectively.

This dependence on one person meant that a large amount of capital possessed by these companies was at the whim of one man. Whilst that person might have had benevolent causes in mind, they are also prone to insatiable greed (establishing monopolies) and treating their employees as expendable. i.e. they are like Shinra corporation.

Then enter the 20th century: General Motors and General Electric are on the rise. They discover a neat trick - if you sell some of your shares (a.k.a. "stock") to the public, you can grow much faster.

To be honest, it is kinda strange they didn't figure it out earlier. The earliest modern Initial Public Offering (when a previously private company goes public) in the US was recorded in the 18th century (Bank of North America, 1783). Europe had it earlier - 17th century (the Dutch East India Company, 1602).

A stock exchange was created as a place to sell/ buy such shares.

We get to the following concept:

Stock market - all of the money in the world tied up in shares.

The whole idea of the stock market as a force for good is as follows:

The possibility of future payouts encourages the public to invest in a company. Still, if their CEO makes terrible decisions - people sell those shares. Hence, the stock market incentives companies to make good decisions -> to give more money back to their shareholders -> create jobs and grow the enterprise. Everyone wins.

In post-World War 2, the stock market helped the US propel an average American (primarily white) into the middle class. The "American dream" has been made possible thanks to publicly traded companies:

superior returns for investors

millions of secure and well-paid jobs

innovative products bought worldwide

Thus, the CEOs of that time saw themselves as stewards of great public institutions. These public institutions were supposed to serve 5 pillars: shareholders, suppliers, bondholders, employees and the community.

Hence, there was a time when businesses felt equally responsible for their community and their profits.

Yet there was a guy who considered otherwise, and for a good reason. His name is Milton Friedman, a famous economist and a Nobel laureate. Milton published a legendary article for the New York Times magazine in 1970 titled "The social responsibility of business is to increase its profits". It quite literally changed the world.

It is a well-preserved piece of history that argues that the sole responsibility of businesses is to maximise returns for shareholders. I.e. no more 5 spokes, but rather one and only - shareholders. You can read it for yourself here, but here is a summary of few key points:

When executives decide to spend money on social responsibility, they impose' tax' on employees/ shareholders/ customers. Yet, they are not public officers and don't have such right.

In capitalism, companies should decide where to spend money/effort based on market mechanisms. To make that selection based on the political mechanism is a socialist idea. Plus, executives are hired by shareholders to execute their goals.

There is little difference in impact between donating as a firm or as an individual. Furthermore, in some cases, corporate donations may mask money laundering.

Executives should focus on what they do best - increase the profitability of their firm. That would mean more money for shareholders to spend on socially responsible causes.

Composite objectives (like the 5 spokes) suffer from a lack of rigour. "A point in every direction is the same as no point at all".

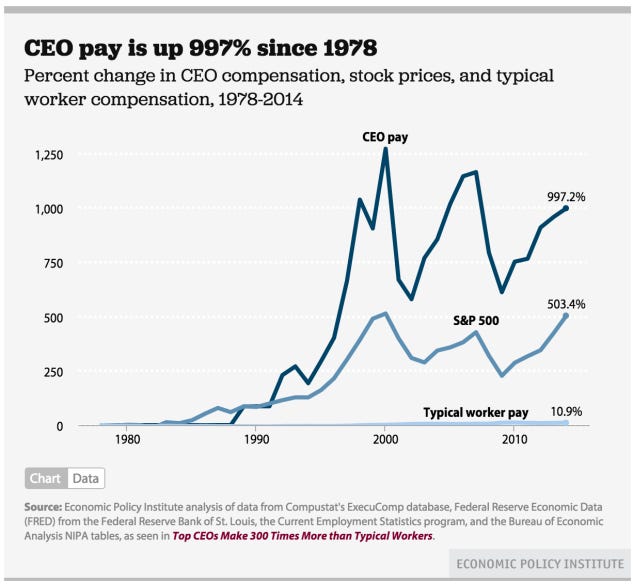

His views received lots of support among shareholders of public corporations, and a new incentive was introduced. Since then, CEOs had their salary pegged to an increase in the share price (the share price performance). This had a considerable knock-on effect: in the 1970s (when Friedman's doctrine was just introduced), an average CEO's pay was 22x (times) the amount of an average worker's pay. By 2016 - it is 271x (times) more.

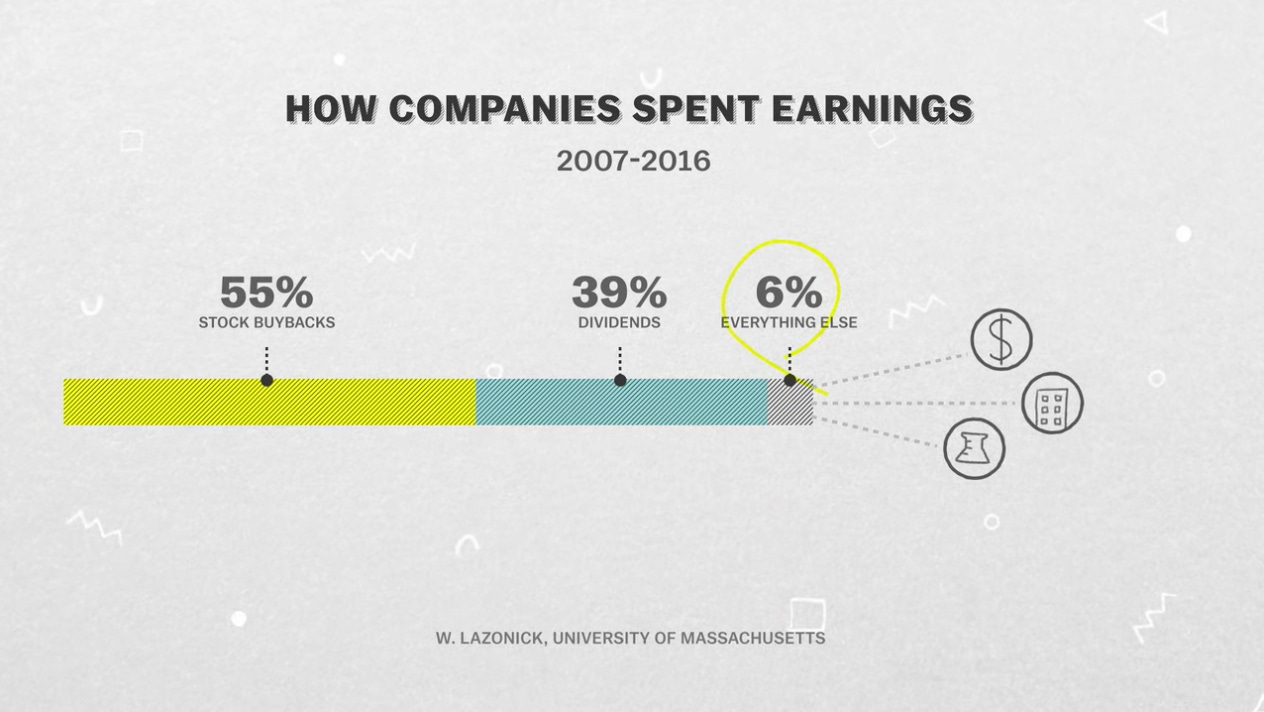

This is how we arrive at today. As an executive, if you know that 80% of your payout will depend on the share price performance, you will do your best to make sure it goes up. Examples include: cutting costs, buying back their shares from the public (manipulating stock price).

Such incentive alone leads to short-sighted decisions with negative consequences that are harmful to employees, customers, society, the environment and even the company itself in the long run. Hence, good news for the stock market doesn't necessarily mean the same for the economy.

Does it mean we are screwed?

Not necessarily.

Corporations should indeed focus on serving their shareholders. Yet, we should recognise that corporations are much better than individuals at achieving shareholders' goals - as argued by Oliver Hart, also a Nobel laureate in economics (but from 2016 - so much more recent). And those goals can relate to social and environmental impact and be measurable.

For example, a mining company could:

stop operating an environmentally damaging mine

go ahead with it & pay out dividends to shareholders who could use that money for damage control

In the first case, we prevent the damage. In the latter case - we mitigate it.

So in a way, Friedman's doctrine has been incomplete and dangerously misinterpreted. What shareholders care about is not always the bottom line (i.e. the share price performance). Especially with a public opinion on issues like climate crisis is changing, it is more important than ever for shareholders to influence the companies they own.

What can you do as a shareholder/ employee/ consumer? There are 2 mechanisms available for influencing companies: exit or voice, according to Hart.

Q: What is "exit"?

A: Exit refers to things like shareholders divesting from companies (selling their shares), or consumers boycotting their product, or workers refusing to work for "dirty" companies.

Q: What is "voice"?

A: Shareholders using their votes, or other ways, to engage with management and force company change.

The exciting thing is that using voice can be more impactful than exit in a highly competitive society in many cases. You can read the paper here.

Unfortunately, at the moment, the US government is making voice much more difficult. For example, private pension fund managers might not be allowed to take the Environmental, Social and Governance (shortly ESG) factors in the US into account soon. That is regardless of what goals investors (i.e. the majority of the working population) are after.

Q: what if they are after socially responsible investing?

A: Tough luck.

The latest research by Hart argues that solving the problem of communication between shareholders and executives would be a step in the right direction to bring more 'good' as a consequence of greed.

What could the future of corporations look like?

Note: the following is an opinion of the author.

Recently I have been reading a lot on the topic of decentralisation. I was especially interested in decentralised consensus and what it could mean for the future of corporate governance (how companies are being run).

Currently, a company's shareholders would elect a representative to join the board meetings. That's it. That is all the influence you have on the direction that a company takes. 😂

Okay, you have a bit more: you can vote for or against various corporate actions (including adding or removing members of a firm's board of directors).

A bit better, yeh?

However…

Minority shareholders (ones who own 1% or lower of the entire company) can only achieve some level of impact when they manage to self-organise as a united force. That is where the challenge comes in - communication and coordination in reaching consensus. Some people use platforms like Reddit to rally people up to give more weight to their innovative suggestion. Yet, it is always a slog, plus not many shareholders would use Reddit.

Imagine a system where every shareholders' voice be heard. Also, a share of a company is not a physical piece of paper but a piece of code that serves as the following:

Proof of ownership (i.e. a contract)

Book with all rules on how that organisation is run

Ticket to participate in the debate that allows you to put your suggestions forward and vote on new initiatives

Now imagine that it also automatically carries out the group's decision - that is what many people refer to as smart contracts.

You can build whole applications and even organisations based on smart contracts. They are called Decentralised Applications (available today) and Decentralised Autonomous Organisations (still a few years away).

The idea of removing hierarchy in organisations is not a novel one, but previously it was not technically feasible. With the onset of (decentralised) smart contracts, it could become a reality. Thus, we will avoid living in a world of Shinra corporation.

I highly recommend starting to get yourself educated on the topic of decentralisation - technologies like Ethereum and PolkaDot are the most popular platforms at the moment.

But not to get overwhelmed, I suggest you start chatting regularly with a friend/ acquaintance who is somewhat knowledgeable in this field and could help you navigate it. If you don't have such friend, there are some great communities online (like Finimize). The only thing advantage of knowing people personally - you are more likely to avoid bad actors (i.e. those who spread misinformation, scammy schemes etc.).

Wow, it feels great to finish this article on a positive note! If you, my reader, have read till the end, please please let me know:

Did you enjoy this article?

What did you learn from it?

I love reading people's reactions to my content 🥰

I received a fantastic email from Marcus, who heard of this publication from a friend, shortly after publishing the previous article. His encouraging feedback really gave me the motivation to stick with this publication! Hence, I tried to go a little further with this one 🤠

Again, a huge thank you to Marcus!

If there are people, you follow and admire silently, letting them know what you think means a lot to them 🥰

Also, I would love some suggestions from you, my readers, on what you would like me to write next. 🙏

I could cover:

A) another one on Final Fantasy 7 - this time about eco-terrorism

B) Outriders game - existential threats to humanity

C) Something else

I really liked how you connect game story to real world, explore that connection in depth yet keep it succinct and easy to read! The end note on decentralised corporate ownership and governance is really cool too and promotes further reading, very well done!